Issue #33 – Invoice Illusions: 3 Ways Paper Turns into Profit

Polar Insider | Issue #33 | Week of 15 October 2025

🧊 Introduction

Hello,

Welcome to this week’s edition of Polar Insider.

This issue focuses on Invoice Illusions: 3 Ways Paper Turns into Profit, exploring how false invoicing has become a key tool in trade-based money laundering (TBML). From over/under-invoicing to duplicate billing and phantom shipments, we examine how these methods disguise illicit funds as legitimate trade.

Here’s what’s included:

📌 Top Story – Invoice Illusions: 3 Ways Paper Turns into Profit

🔎 Case Study – Chennai’s Phantom Electronics Exports

🌍 Regulatory Roundup – Updates from FinCEN, the UK, and Asia-Pacific regulators

🧰 Compliance Toolkit – Resources for detecting TBML and invoice fraud

📌 Top Story – Invoice Illusions: 3 Ways Paper Turns into Profit

🎥 Prefer to watch? Catch the 1min explainer:

Criminals are using trade documents to launder money by manipulating invoices — misstating prices, quantities, or even the existence of goods.

These “invoice illusions” are central to TBML schemes, which are both profitable and difficult to detect. Research from Global Financial Integrity estimates that over $60 billion in illicit funds were laundered through trade misinvoicing in a decade. Common methods include over/under-pricing goods, multiple invoicing, and phantom shipments, all of which exploit the complexity of global trade.

What’s Happening 🔍

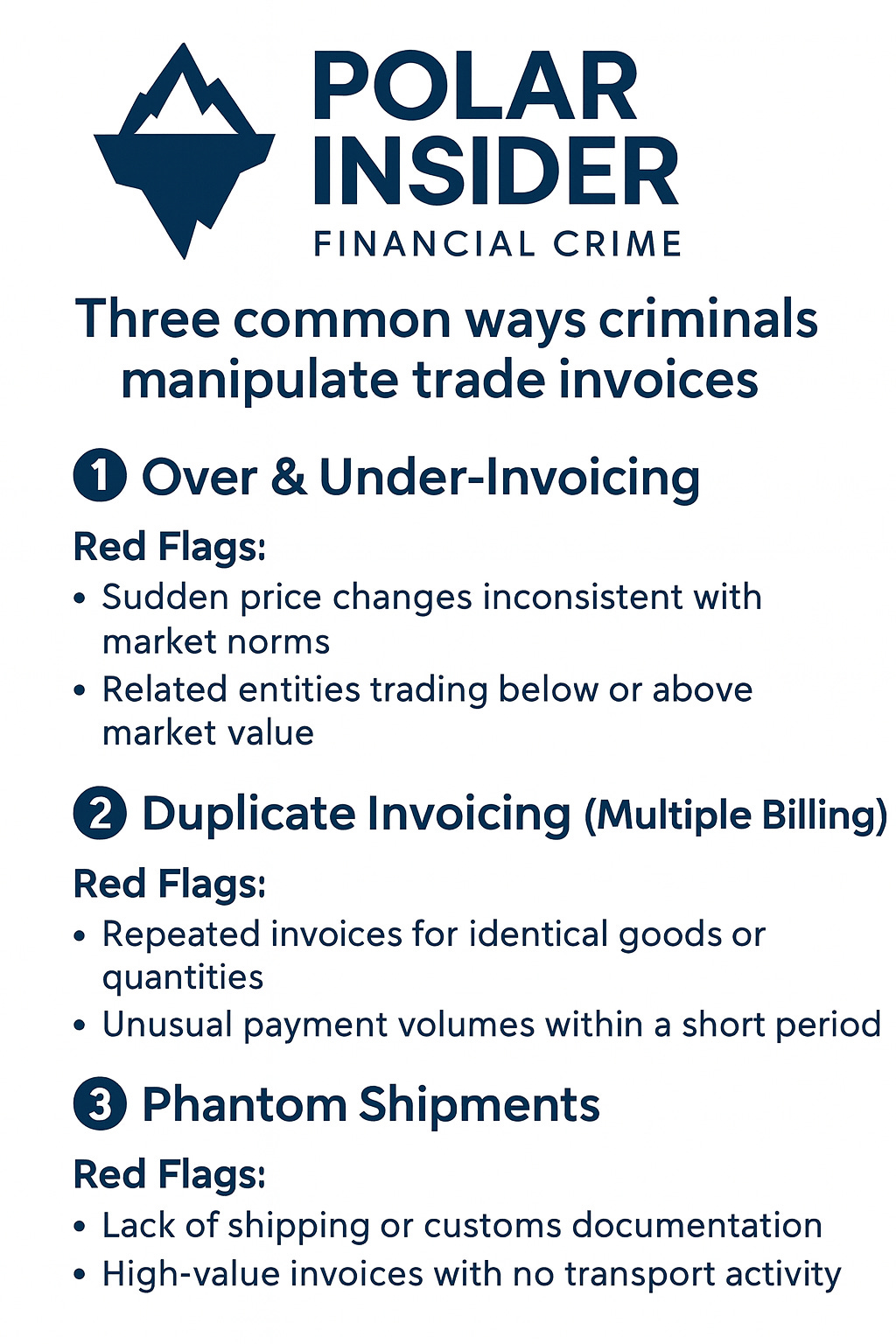

Here are three common ways criminals manipulate trade invoices:

1️⃣ Over & Under-Invoicing

Criminals inflate or deflate the value of goods on invoices to shift funds between colluding parties.

Example: An exporter declares a low-value good at an inflated price, receiving surplus payments that carry illicit funds abroad. Conversely, valuable goods can be underpriced so the importer pays less, leaving profits overseas.

Red Flags:

Sudden price changes inconsistent with market norms

Related entities trading below or above market value

💡 Why it works: Banks and customs often lack reliable price benchmarks, allowing mispricing to go unnoticed.

2️⃣ Duplicate Invoicing (Multiple Billing)

Multiple invoices are issued for the same shipment to justify extra payments.

Example: An exporter ships $100,000 worth of goods but sends five separate $100,000 invoices to different banks. The importer, in collusion, makes five payments totaling $500,000 for a single shipment.

Red Flags:

Repeated invoices for identical goods or quantities

Unusual payment volumes within a short period

💡 Why it works: Without centralized trade-data monitoring, duplicate payments appear routine.

3️⃣ Phantom Shipments

Invoices are created for goods that don’t exist.

Example: An exporter generates an invoice for 100 tons of sugar or electronics, and the importer pays for it — but no goods are ever shipped.

Red Flags:

Lack of shipping or customs documentation

High-value invoices with no transport activity

💡 Why it works: Open-account trade relies heavily on trust. Financial institutions rarely verify whether goods were physically shipped.

⚙️ Why These Schemes Work

Fragmented Oversight: Banks see payments and invoices but not the physical goods. Customs officials see goods but not the funds behind them.

Lack of Data Sharing: Limited collaboration between banks, customs, and regulators creates blind spots.

Sheer Volume: With over $24 trillion in global trade annually, even a small percentage of illicit transactions can amount to billions.

How Financial Institutions Are Responding

Banks are addressing these risks by:

Using Trade Analytics: Leveraging machine learning and commodity price databases to flag anomalies.

Collaborating with Regulators: Engaging in public-private partnerships like the U.S. Trade Transparency Units.

Enhancing Due Diligence: Scrutinizing trade finance clients’ routes, counterparties, and goods for unusual patterns.

Risks for Financial Institutions:

⚠️ Regulatory exposure through fines and sanctions

⚠️ Credit losses from financing non-existent goods

⚠️ Reputational damage following media or regulatory probes

What You Can Do ✅

Here are three steps to mitigate invoice fraud:

Know Your Customer (KYC): Understand your clients’ trade activities, shipment sizes, and trading partners. Investigate transactions that don’t align with their profile.

Use Trade Analytics: Deploy tools to detect mispricing, duplicate shipments, and other anomalies.

Verify and Collaborate: Cross-check trade documents and collaborate with other institutions and regulators.

🔍 Case Study

Chennai’s Phantom Electronics Exports

Between 2016 and 2021, a Chennai-based network laundered ₹120 crore (≈$14 million USD) through fake electronics invoices to Hong Kong.

What Happened:

Shell companies fabricated invoices for imports that never occurred. Payments were routed to Hong Kong accounts under their control.

Outcome:

Seven individuals were convicted under India’s Prevention of Money Laundering Act — one of the few successful TBML prosecutions in the region.

Red Flags:

Shell entities with no legitimate operations

Unusually high-value transactions for small firms

Missing shipping or customs records

💡 Lesson Learned: Even moderate-scale TBML cases can trigger international investigations when payment and trade data misalign.

🌍 Regulatory Roundup

🇺🇸 North America

FinCEN Alert: The U.S. Financial Crimes Enforcement Network issued a warning about Chinese money laundering networks exploiting trade.

Canada: New AML regulations enhance corporate transparency and information sharing.

🇬🇧 Europe

UK Risk Assessment: The UK’s 2025 National Risk Assessment highlights TBML as a significant threat.

EU AML Regulation: Stricter trade finance standards are being finalized under the new AML Regulation and 6th Directive.

🇮🇳 Asia-Pacific

India: A landmark TBML conviction involving fake electronics invoices sets a precedent.

Hong Kong & Singapore: Both jurisdictions have strengthened trade finance controls and AML guidelines.

Compliance Toolkit 🧰

Resources to help combat TBML:

FATF/Egmont TBML Report (2020) – Comprehensive typologies and red flag indicators.

📎 Link → fatf-gafi.org

FinCEN Advisory on Chinese Money Laundering Networks (2025) – Guidance on TBML typologies used by cartels and red flags for FIs.

📎 Link → fincen.gov

AUSTRAC Financial Crime Guide: Preventing TBML (2022) – Practical indicators and case studies for detecting trade-based laundering, from Australia’s regulator.

📎 Link → austrac.gov.au

Quote of the Week 💬

“Even regulators joke that detecting TBML is like finding a needle in a stack of needles.”

— Andrew McCarthy, FTI Consulting expert

🎁 Bonus for Subscribers

Download the 2025 Financial Crime Regulatory Tracker (USA | UK | AU) to stay ahead of beneficial-ownership and AML reform deadlines.