Issue #23 - How to Identify Illegal Phoenix Activity

Polar Insider | Issue #23 | Week of 06 August 2025

🧊 Introduction

Illegal phoenix activity - the practice of stripping a company of its assets to transfer them to a new entity, leaving creditors and employees unpaid - continues to plague economies worldwide. This edition of Polar Insider examines how phoenix schemes operate across jurisdictions, their typologies and impacts, and actionable strategies for regulators and compliance officers to identify and disrupt these schemes.

Here’s what’s inside this global issue:

📌 Top Story – How to Identify Illegal Phoenix Activity

🔎 Case Study – Sydney “Caravan Park” Phoenix Syndicate

🌍 Regulatory Roundup – Updates from North America, Europe, and Asia-Pacific

🧰 Compliance Toolkit – Multijurisdictional Resources for Tackling Phoenix Activity

📌 Top Story

How to Identify Illegal Phoenix Activity

The term “phoenixing” evokes the mythical bird rising from its ashes. In the business world, however, it represents something far less noble. Phoenixing refers to the deliberate winding up of a company, transferring its assets to a related entity, and continuing operations under a new name -leaving behind unpaid debts.

While not all phoenix activity is illegal (legitimate restructures can save jobs and pay creditors), illegal phoenixing occurs when directors intentionally transfer assets without fair compensation to dodge liabilities. For example, in the U.S., such transfers can constitute fraudulent conveyance under bankruptcy laws, and globally, authorities view these schemes as serious corporate fraud.

What’s Happening?

Illegal phoenix activity is a global issue, costing governments and businesses billions in lost revenue and unpaid debts. In Australia alone, the direct costs of phoenixing are estimated at up to A$5.1 billion annually. Other regions face similar challenges:

UK: The Insolvency Service warns of “abusive phoenixism” and has aggressively pursued rogue directors. A notable case involved the “Phoenix Four” of MG Rover, where directors manipulated assets, leaving £1.3 billion in unpaid debts.

US: Authorities have prosecuted similar schemes as bankruptcy fraud. For instance, a Boston business owner pled guilty after secretly transferring assets to a new company before declaring bankruptcy.

Industries most affected include construction, labor hire, hospitality, transportation, and retail—sectors with high turnover and subcontracting, which fraudsters exploit.

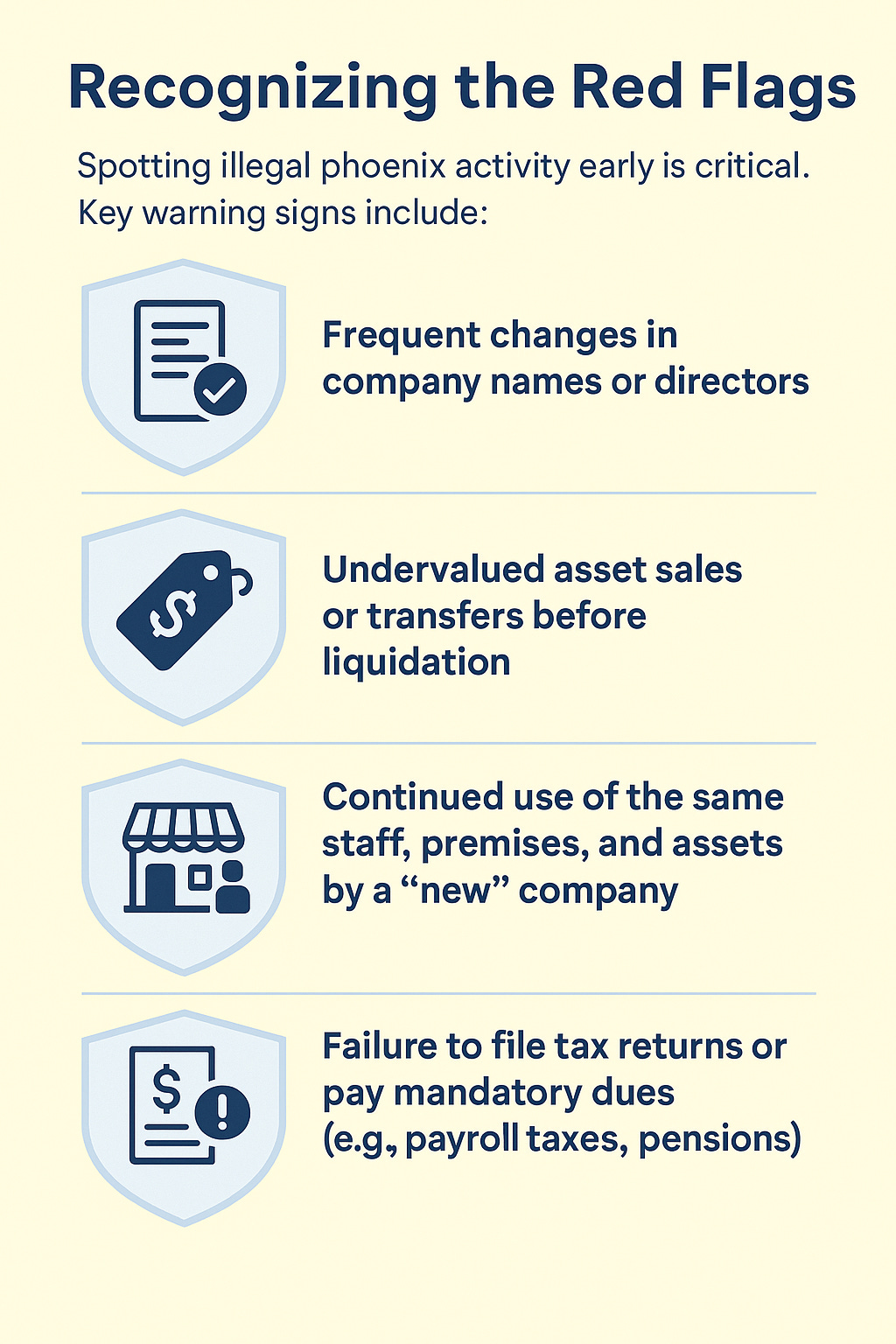

What You Can Do

Organizations can take proactive steps to combat phoenix activity:

✅ Know Your Client and Beneficial Owners: Conduct enhanced due diligence to identify directors linked to multiple insolvencies or banned from directorship.

✅ Verify Asset Transfers: Scrutinize asset sales for undervaluation or sweetheart deals.

✅ Monitor Tax and Filing Compliance: Repeated failures to file taxes or pay dues can signal phoenixing.

✅ Leverage Data-Matching Tools: Use regtech solutions to flag common directors, addresses, or connections between entities.

✅ Engage with Regulators: Report suspected phoenix activity to relevant authorities.

🧠 Pro Tip: Use official registries like Australia’s Director ID system or the UK’s disqualified directors register to uncover patterns of misconduct.

🔎 Case Study

Sydney “Caravan Park” Phoenix Syndicate

Summary

This case highlights a sophisticated phoenix scheme orchestrated by Sydney accountant Wayne Fraser through his advisory firm, Maxum Enterprises. Using dummy directors like Jamyson Taylor-Leigh Curthill - a caravan park resident with no assets - Fraser allegedly facilitated the liquidation of over 20 companies, leaving creditors and workers unpaid. The scheme involved asset transfers, falsified documents, and shadow directorships, resulting in significant financial losses and regulatory scrutiny.

What Happened

Pretext:

Wayne Fraser allegedly advised clients to move assets out of struggling companies and replace legitimate directors with straw figures, such as Curthill, before initiating insolvency proceedings. This tactic allowed the companies to shed liabilities while continuing operations under new entities.

The Scheme Unfolds:

Curthill, who reportedly had no knowledge of his appointments, was named as director across dozens of insolvent firms, including Embrace Australia Pty Ltd, Situbusit Pty Ltd, and Maiorana Marketing Pty Ltd. At least one dummy director was linked to as many as 13 companies. These entities were systematically wound up, leaving substantial unpaid debts to creditors and workers.

Execution:

Fraser allegedly falsified documents and made misleading statements to facilitate the phoenix schemes. The companies involved accrued significant liabilities, including A$800,000 owed to creditor Neil Webster, before being liquidated. Fraser is now facing 16 criminal charges from ASIC, with potential penalties of up to A$42,000 per offence and/or five years’ imprisonment.

Discovery & Aftermath

The scheme came to light through investigations by ASIC, which uncovered the use of dummy directors and fraudulent asset transfers. Fraser’s actions have been labeled as “professional phoenixing” by affected creditors. ASIC’s prosecution of Fraser underscores the regulatory focus on dismantling such schemes. The case remains under active prosecution, with regulators closely monitoring for further referrals.

Key Lessons for Compliance Teams

🚨 Strengthen Due Diligence on Directors

Ensure thorough background checks on directors and beneficial owners. Tools like Australia’s Director ID system can help identify patterns of misconduct, such as repeated appointments to failed companies.

🔐 Monitor Asset Transfers Closely

Scrutinize asset movements, especially before insolvency proceedings. Unusually low valuations or last-minute transfers to related entities should raise red flags.

🧱 Collaborate with Regulators

Report suspicious activity to relevant authorities and leverage multi-agency collaboration. Sharing intelligence can help uncover complex networks of phoenix activity and prevent further abuse.

🌍 Regulatory Roundup

🎥 Prefer to watch? Catch the 60-sec explainer:

🇺🇸 North America

FinCEN delays its Investment Adviser AML rule to 2028.

U.S. task forces continue cracking down on bankruptcy fraud.

🇪🇺 Europe

The Wolfsberg Group updates financial crime guidance.

The EU works on balanced transparency measures for beneficial ownership registries.

🇦🇺 🇸🇬 Asia-Pacific:

Australia’s Phoenix Taskforce raised AU$99 million in tax liabilities last year.

Singapore’s MAS fined nine institutions S$27.45 million for AML failures.

🧰 Compliance Toolkit

Take advantage of these resources to combat phoenix activity:

Australia: ABN Lookup and Director ID.

Global: OpenCorporates for cross-border corporate data.

Singapore: ACRA BizFile+.

🧠 Quote of the Week:

"Sunlight is said to be the best of disinfectants." – Justice Louis Brandeis

🎁 Bonus for Subscribers

Don’t forget to download your copy of the 2025 Financial Crime Regulatory Tracker (USA, UK, AU).

Stay on top of AML requirements and enforcement trends globally.

👉